Learning Center

How to use actuarial functions?

The ACTUARIAL TOOLBOX comes with the most standard actuarial functions used for life-contingent products. The full list of actuarial functions is presented below:

| # | Function Name | Function Description |

|---|---|---|

1 |

sActuarialTablesList |

Returns all actuarial tables in the database. |

2 |

sActuarialTableValues |

Returns the values of the selected table. |

3 |

sActuarialTableName |

Returns the name of the table for the specified table number. |

4 |

sActuarialqxVector |

Returns the mortality rates, morbidity rates or scale of selected table. |

5 |

sActuarialqxValue |

Returns the mortality rate, morbidity rate or scale in selected table at a given age. |

6 |

sActuarialpxValue |

Returns the survivorship probability in selected table at a given age. |

7 |

sActuarialpxVector |

Returns the survivorship probability of selected table. |

8 |

sActuarialnpxValue |

Returns the probability that a life age x will survive n years. |

9 |

sActuarialnpxVector |

Returns a vector with the probabilities of an individual aged x to be alive at ages 0-130. |

10 |

sActuarialqxnpxVector |

Returns a vector with the probabilities of an individual aged x dying on the exact age of 0-130. |

11 |

sActuarialexValue |

Returns the remaining life expectancy of a person aged x. |

12 |

sActuarialOmegaValue |

Returns the age that can not be achieved by any person of the initial population. |

13 |

sActuariallxVector |

Returns a vector with the number of living people at ages 0-130. |

14 |

sActuariallxValue |

Returns the number of persons who attain age x. |

15 |

sActuarialdxVector |

Returns a vector with the number of people who die at ages 0-130. |

16 |

sActuarialdxValue |

Returns the number of persons who die between ages x and x+1. |

17 |

sActuarialTable |

Returns the complete life table for selected table. |

18 |

sActuarialRANDqxVector |

Returns a random vector representing ages 0-130 of an individual aged x with the states 0 for living or healthy and 1 for dead or disabled. |

19 |

sActuarialRANDqxValue |

Returns a random age of death or disability of an individual aged x. |

20 |

sActuarialRANDqxVectorPopulation |

Returns a random vector with the number of people who died or became disabled at ages 0-130. |

21 |

sActuarialRAND3qxVector |

Returns the respective random states at ages 0-130 of an individual aged x: 1 = is disabled, 1 = dead of a healthy person, 1 = dead of a disabled person. |

22 |

sActuarialRAND3qxValue |

Returns a random vector with ages in which the events of becoming disabled, death of a healthy person and death of a disabled person occurred. |

23 |

sActuarialRAND3qxVectorPopulation |

Returns a random vector with the numbers: alive and healthy people, alive and disabled people, deaths of healthy persons and deaths of disabled persons. |

24 |

sActuarialGenerationalTableqxMatrix |

Returns a collection of mortality rates projected by year. |

25 |

sActuarialGenerational2dTableqxMatrix |

Returns a collection of mortality rates projected by year. |

26 |

sActuarialGenerationalTableqxVector |

Returns the appropriate mortality rates vector for an individual aged x using a generational mortality table. |

27 |

sActuarialGenerational2dTableqxVector |

Returns the appropriate mortality rates vector for an individual aged x using a generational mortality table. |

28 |

sActuarialnpxnpixVector |

Returns a matrix with the probabilities of an individual aged x to be alive and healthy (column 1) and the probabilities of him to be alive and disabled (column 2) at ages 0-130. |

29 |

sActuarialTableMultipleDecreases |

Returns multiple decrement life table. |

30 |

sActuarialFlatRateVector |

Returns a vector of size 131 with the specified yield rate. |

31 |

sActuarialnpxnpixVectorMultipleDecreases |

Returns a matrix with the probabilities of an individual aged x to be alive and healthy (column 1) and the probabilities of him to be alive and disabled (column 2) at ages 0-130. |

32 |

sActuarialnqxnqixVector |

Returns the cumulative probability of an individual aged x dying by any decrement (death of a healthy person or death of a disabled person) at ages 0-130. |

33 |

sActuarialnpxForecastVector |

Returns a vector with the probabilities of an individual aged x to be alive at years 0-130. |

34 |

sActuarialqxnpxForecastVector |

Returns a vector with the probabilities of an individual aged x dying on the exact years of 0-130. |

35 |

sActuarialnpxnpixForecastVector |

Returns a matrix with the probabilities of an individual aged x to be alive and healthy (column 1) and the probabilities of him to be alive and disabled (column 2) at years 0-130. |

36 |

sActuarialnpxnpixMultipleDecreasesForecastVector |

Returns a matrix with the probabilities of an individual aged x to be alive and healthy (column 1) and the probabilities of him to be alive and disabled (column 2) at years 0-130. |

37 |

sActuarialdummyForecastVector |

Returns a vector to indicate in the years 0-130 the occurrence of a permanent event at age 'xevent' of an individual with age 'xnow'. |

38 |

sActuarialdummyVector |

Returns a vector to indicate in the ages 0-130 the occurrence of a permanent event at age 'xevent' of an individual with age 'xnow'. |

39 |

sx |

Returns a vector with the ages 0-130. |

40 |

sActuarialxForecastVector |

Returns a vector with the projected ages of an individual aged x in the years 0-130. |

41 |

sActuarialvalueForecastVector |

Returns a vector for the years 0-130 with the specified value at age 'xevent' of an individual with age 'xnow'. |

42 |

sActuarialAccruedInterestForecastVector |

Returns the accumulated yield factor for the years 0-130. |

43 |

sActuarialAnnuityCertainPresentValue |

Returns the present value of an annuity-certain per annum for n years. |

44 |

sActuarialAnnuityCertainFutureValue |

Returns the accumulated amount of an annuity-certain per annum for n years. |

45 |

sActuarialAnnuityLiability |

Returns the present value of an annuity to continue during the person's life, but not after the year n. |

46 |

sActuarialAnnuityCashFlows |

Returns the cash flows of an annuity to continue during the person's life, but not after the year n. First column = raw cash flow, second column = actuarially projected cash flows, third column = financially and actuarially discounted cash flows. |

47 |

sActuarialAssuranceLiability |

Returns the present value of an assurance valid for n years and payable at the end of the year of the person's death. |

48 |

sActuarialAssuranceCashFlows |

Returns the cash flows of an assurance valid for n years and payable at the end of the year of the person's death. First column = raw cash flows, second column = actuarially projected cash flows, third column = financially and actuarially discounted cash flows. |

49 |

sActuarialSalaryPurchasingPowerFactor |

Returns a factor to adjust the effect of monthly inflation on real annual income. |

50 |

sActuarialSocialSecurityConstantGrowthForecastVector |

Returns the Social Security benefit projection for years 0-130. |

51 |

sActuarialSocialSecurityVectorGrowthForecastVector |

Returns the Social Security benefit projection for years 0-130. |

52 |

sActuarialSalaryGrossForecastVector |

Returns the salary projection for years 0-130. |

53 |

sActuarialSalaryNetForecastVector |

Returns the portion of the salary that exceeds the Social Security benefit. |

54 |

sActuarialContributionsForecastVector |

Returns the projected contributions of employees (column 1) and retirees (column 2) for years 0-130. |

55 |

sActuarialnpxDependentForecastVector |

Returns a vector with the probabilities that at least one valid dependent will survive at the end of years 0-130. |

56 |

sActuarialSpotInterestRatesToDiscountFactorForecastVector |

Converts a vector of spot interest rates to a vector of discount factors. |

57 |

sActuarialForwardInterestRatesToSpotInterestRatesForecastVector |

Converts a vector of forward interest rates to a vector of spot interest rates. |

58 |

sActuarialSpotInterestRatesToForwardInterestRatesForecastVector |

Converts a vector of spot interest rates to a vector of forward interest rates. |

59 |

sActuarialForwardInterestRatesToDiscountFactorForecastVector |

Converts a vector of forward interest rates to a vector of discount factors. |

60 |

sActuarialEndSalaryAssuranceCashFlows |

Returns the cash flows of an end salary assurance payable at the end of the year of the person's death. First column = actuarially projected cash flows, second column = financially and actuarially discounted cash flows. |

61 |

sActuarialCashFlows |

Returns a complete report of the cash flows of a complex pension scheme. Insert function via ACTUARIAL TOOLBOX tab to recover headers. |

62 |

sActuarialCashFlowsMultipleDecreases |

Returns a complete report of the cash flows of a complex pension scheme. Insert function via ACTUARIAL TOOLBOX tab to recover headers. |

63 |

sActuarialRANDqxDependentForecastVector |

Returns a random binary matrix indicating pension situation. First column, 1 = Employee alive and healthy; second column, 1 = Retired alive and healthy; third column = Retired disabled; forth column = person is dead with living dependents. |

64 |

sActuarialRANDCashFlows |

Returns a complete report of the random cash flows of a complex pension scheme. Insert function via ACTUARIAL TOOLBOX tab to recover headers. |

65 |

sActuarialBenefitsLiability |

Returns the present value of a complex pension scheme. |

66 |

sActuarialBenefitsLiabilityMultipleDecreases |

Returns the present value of a complex pension scheme. |

67 |

sActuarialEndSalaryAssuranceLiability |

Returns the present value of an end salary assurance payable at the end of the year of the person's death. |

68 |

sActuarialRANDBenefitsLiability |

Returns a random present value of a complex pension scheme. |

69 |

sActuarialCashFlowsVector |

Extracts the actuarial projection of cash flows calculated using the function "sActuarialCashFlows", "sActuarialCashFlowsMultipleDecreases" or "sActuarialRANDCashFlows". |

70 |

sActuarialBenefitsLiabilitiesVector |

Extracts the actuarial projection financially discounted of cash flows calculated using the function "sActuarialCashFlows", "sActuarialCashFlowsMultipleDecreases" or "sActuarialRANDCashFlows". |

The usage of actuarial tables in actuarial functions is highly flexible and it can be done by one of the following methods (see examples below):

- Using the number of a table registered in the database (this is the default option);

- Using the name of a table registered in the database;

- Using the table values inserted in an Excel range; and

- Entering the qx vector directly as a function argument.

A |

B |

C |

D |

|

1 |

Life expectancy at age 60 (table UP 1994 female) |

|

|

|

2 |

Using table number |

24.96938061 |

=sActuarialexValue(6,60) |

|

3 |

Using table name |

24.96938061 |

=sActuarialexValue("UP1994F",60) |

|

4 |

Using table range |

24.96938061 |

=sActuarialexValue(B10:B140,60) |

|

5 |

Entering the qx vector |

24.96938061 |

=sActuarialexValue(sActuarialqxVector("UP1994F"),60) |

|

6 |

|

|

||

7 |

|

|

|

|

8 |

Table UP 1994 female |

|

|

|

9 |

Age |

Mortality rates (qx) |

|

|

10 |

0 |

0.00000 |

=sActuarialqxVector("UP1994F") |

Note: after entering this formula click on the "Multiple Values Formula" button. |

11 |

1 |

0.00057 |

|

|

… |

… |

… |

|

|

139 |

129 |

1.00000 |

|

|

140 |

130 |

1.00000 |

|

|

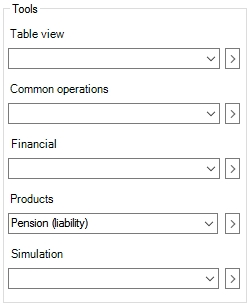

Besides the option of calling the function directly in Excel, there is also the option to insert a template of usage of the function choosing one of the options in the tools group.

For instance, if you want to calculate the actuarial liability of an individual in a pension fund the following result can be immediately achieved by clicking on the “Products/Pension (liability)” option:

|

A |

B |

C |

1 |

Actuarial liability (Defined Benefit) |

|

|

2 |

|

|

|

3 |

Retired contribution |

0.05 |

|

4 |

Worker contribution rate over gross salary |

0 |

|

5 |

Worker contribution rate over net salary (gross - social security) |

0.1 |

|

6 |

Administrative costs |

0.1 |

|

7 |

Current gross salary (annual) |

100000 |

|

8 |

Current age |

30 |

|

9 |

Retirement age |

65 |

|

10 |

Growth (real) rate of worker salary |

0.03 |

|

11 |

Growth (real) rate of retired pension |

0 |

|

12 |

Disability entrance table |

80 |

|

13 |

Life table normal life |

6 |

|

14 |

Life table disabled life |

3 |

|

15 |

Current Social Security reference benefit (annual) |

30000 |

|

16 |

Growth (real) rate of Social Security reference benefit |

0.01 |

|

17 |

Is normal |

TRUE |

|

18 |

Forward (real) interest rate curve |

0.05 |

|

19 |

Life table dependent |

1 |

|

20 |

Expected inflation rate |

0.05 |

|

21 |

Life insurance benefit (% over salary) |

0.083333333 |

|

22 |

Age at wedding |

27 |

|

23 |

Children maximum age to receive benefits |

20 |

|

24 |

Partner age |

28 |

|

25 |

First child age |

1 |

|

26 |

Second child age |

-2 |

|

27 |

Third child age |

131 |

|

28 |

Fourth child age |

131 |

|

29 |

Fifth child age |

131 |

|

30 |

Extra worker contribution |

0 |

|

31 |

Limiting age to become disabled |

130 |

|

32 |

Retirement salary conversion rate |

1 |

|

33 |

Dependent benefit conversion rate |

1 |

|

34 |

Actuarial liability |

$ 613,131.82 |

=-sActuarialBenefitsLiability($B$3,$B$4,$B$5,$B$6,$B$7,$B$8,$B$9,sActuarialFlatRateVector($B$10), sActuarialFlatRateVector($B$11),sMxElemMult(sActuarialqxVector($B$12),sActuarialdummyVector($B$31,1)), $B$13,$B$14,$B$15,sActuarialFlatRateVector($B$16),$B$17,sActuarialFlatRateVector($B$18),$B$19,$B$20, $B$21,$B$22,$B$23,$B$24,$B$25,$B$26,$B$27,$B$28,$B$29,$B$30,$B$32,$B$33) |

35 |

|

|

|